In a world that never seems to slow down, finding ways to simplify daily life and reclaim precious time has become more than just a convenience; it is a necessity. Technology offers a multitude of tools designed to streamline tasks, organize schedules, and handle repetitive chores. From managing your home to optimizing work productivity, these tech tools can transform how you approach daily routines and responsibilities.

Table of Contents

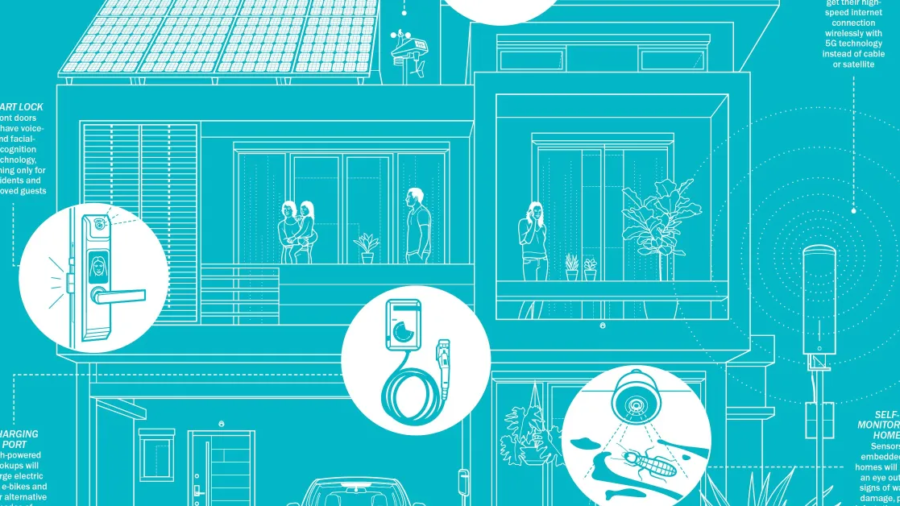

Smart Home Devices: Automating Daily Tasks

Smart home technology has revolutionized the way people manage their living spaces. Devices like smart thermostats, lights, and appliances allow you to automate tasks that once required manual intervention. A smart thermostat, for example, can learn your schedule and adjust the temperature automatically, saving energy and reducing the need for constant adjustments. Similarly, smart lighting systems can turn lights on or off based on motion sensors or scheduled routines, creating convenience while also lowering electricity costs.

Voice-controlled assistants such as Amazon Alexa or Google Assistant extend these capabilities further. You can control multiple devices, play music, manage reminders, or even make shopping lists through simple voice commands. Integrating these systems into your home creates a seamless environment where mundane tasks are handled automatically, freeing up your time for more meaningful activities.

Productivity Apps: Organize Your Work and Life

Staying organized is a cornerstone of saving time, and productivity apps are designed precisely for this purpose. Apps like Trello, Asana, and Notion provide platforms to manage projects, track tasks, and collaborate with others. Trello, for instance, uses a visual board system to help you break projects into smaller tasks and monitor progress efficiently. Notion combines note-taking, project management, and knowledge databases into one versatile app, allowing for customized workflows that fit your personal or professional life.

Time management apps such as Todoist or Microsoft To Do help prioritize daily tasks, set reminders, and maintain focus on what really matters. By keeping all your commitments in one place and offering tools to categorize and track progress, these apps reduce mental clutter and increase efficiency. The result is not just more completed tasks, but less time wasted worrying about deadlines and responsibilities.

Automated Financial Management: Simplifying Money Matters

Managing finances is often time-consuming, but technology has introduced tools that simplify this crucial aspect of life. Budgeting apps like YNAB (You Need A Budget) or Mint help track spending, categorize expenses, and plan savings goals. Many banking apps now offer automatic bill payments, instant transaction alerts, and digital wallets that eliminate the need for physical cash or checks.

For those who frequently shop online or make recurring payments, subscription management apps such as Truebill can identify unnecessary subscriptions and cancel them automatically. These tools not only save time but also help reduce stress by keeping finances organized and transparent.

Grocery and Meal Planning Apps: Streamlining Food Management

Meal planning and grocery shopping can take up hours each week, but apps like Mealime, Yummly, or Instacart simplify this process. Meal planning apps allow you to create weekly menus, generate shopping lists, and even discover recipes based on ingredients you already have. Grocery delivery services, including Instacart and Amazon Fresh, save additional time by bringing your groceries directly to your doorstep.

These tools can also support healthier eating habits by making it easier to plan balanced meals and avoid last-minute takeout decisions. When integrated into your routine, they can significantly reduce the mental and physical load associated with food preparation.

Communication and Collaboration Tools: Staying Connected Efficiently

In both professional and personal life, communication can become a major time sink. Tools such as Slack, Microsoft Teams, and Zoom have streamlined how people collaborate and communicate, reducing the need for in-person meetings or long email chains. Slack, for example, organizes conversations into channels, enabling focused communication and quicker responses. Zoom and other video conferencing platforms allow for instant virtual meetings, eliminating travel time and improving flexibility.

Even outside of work, messaging apps such as WhatsApp or Signal keep you connected with friends and family without requiring lengthy phone calls or in-person meetups. By centralizing communication and offering instant access, these tools help maintain relationships without consuming excessive time.

Travel and Logistics Apps: Simplifying Movement and Deliveries

Transportation and logistics are areas where technology can make a remarkable difference. Apps such as Google Maps or Waze streamline navigation, providing real-time traffic updates, alternate routes, and estimated travel times. Ride-sharing apps such as Uber or Lyft reduce the stress of finding parking and dealing with public transportation schedules.

Shipping and delivery services have also become far more convenient through technology. Platforms such as Shiply shipping services allow users to compare transport options, schedule deliveries, and track items from start to finish. Whether you need to move large furniture, vehicles, or other goods, these services simplify the process and save significant time, allowing you to focus on other priorities rather than logistics.

Health and Fitness Apps: Maintaining Wellness Efficiently

Maintaining health and wellness often competes with busy schedules, but fitness and wellness apps provide an effective solution. Apps such as MyFitnessPal, Strava, or Fitbit help track workouts, monitor nutrition, and set personalized fitness goals. Many offer guided workouts or meditation exercises that can be completed in short periods, maximizing efficiency for people with tight schedules.

Sleep tracking and stress management apps such as Calm or Headspace support mental health by promoting relaxation and mindfulness. These tools help reduce the time spent second-guessing routines or searching for effective wellness strategies, integrating wellness seamlessly into daily life.

Smart Assistants and AI: The Next Frontier in Convenience

Artificial intelligence continues to expand the possibilities for time-saving technology. AI-powered personal assistants can schedule meetings, send reminders, sort emails, and even draft documents. Smart recommendation systems on streaming services, shopping platforms, and news apps learn your preferences, reducing the time spent searching for content or products.

AI chatbots and virtual assistants have also transformed customer service interactions. Tasks that once required long phone calls can now be completed in minutes through automated systems, providing efficiency without compromising accuracy. As AI continues to evolve, the potential for automation and time savings will only increase, making everyday life increasingly effortless.

Integrating Tools for Maximum Efficiency

The true power of these tech tools is realized when they are integrated into a cohesive system. Combining smart home devices, productivity apps, financial tools, and logistics services can create an environment where routine tasks are automated, communication is streamlined, and time is freed for meaningful pursuits. By thoughtfully selecting tools that complement each other, you can reduce redundancy, avoid workflow interruptions, and maintain focus on high-priority activities. The result is not just more free time but also less stress and a greater sense of control over daily life.